|

|

|

|

|

|

| |

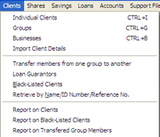

Shares

- Members can buy, sell and transfer shares from one member to another, in cash, by cheque or via the members savings account.

| |

|

| |

- Shares have a nominal value and a current value. The nominal value remains the same, the current value can appreciate or depreciate over time.

- Dividend can be calculated according to the number of months that the shareholder holds the share or independent of this. The period can be set with a minimum of one and a maximum of 12 months.

- Share transactions automatically update the General Ledger.

|

Click to view a larger image |

|

|

| |

|

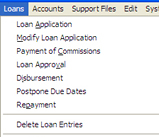

Loans |

|

- Maximum capacity: 1 million loans per branch.

- Maximum loan amount: 999,999,999,999.99.

- Annual interest rates can be set as 3 digits and 8 decimals.

- Maximum interest amount per installment: 100 million.

- Maximum 99 loan products. Loan parameters can be set per product.

- Handles several loan funds and administrator can prevent disbursements from depleted funds. to top

|

Click to view a larger image |

|

- Loans can be entered as loans to individuals, loans to groups with a breakdown of the group loan amount into the amounts that the members received (Village Banking) or as direct lending to members within a group (Grameen lending).

- Loan transactions are automatically booked into the general ledger where each loan product can be linked to its own set of general ledger accounts.

- Handles loan application, payment of commissions, loan approval, disbursement, repayments, loan rescheduling and loan write-off. The commissions can be set as not needed, to be entered before or after loan applications and/or deducted at disbursement and/or with every installment.

- Commissions are either defined as a percentage of the loan amount or as a flat amount. User can decide whether the payment is an income or liability (think of an insurance premium).

- Grace periods supported. User can indicate whether interest should be calculated over the grace period.

- Supported installment periods: daily, weekly, bi-weekly, half-monthly, monthly, bi-monthly, quarterly, four-monthly, semi-annual, annual. It is also possible to get a repayment schedule with only interest payments during the grace period or a balloon payment at the end of the loan cycle.

- The feature of non-working days and weekends prevents due dates to fall on these days. The user can define to change the due dates to the next working day or to the last working day (or not to change them at all).

- Interest can be calculated as flat rate, declining balance amortization or discounted.

- Interest can be calculated either by the number of days of the loan period or according to the installment periods. User can set number of days and number of weeks per year.

- Interest can be deducted from the loan amount at disbursement or fully paid with the first installment.

- Accrued Interest can be calculated and booked into the general ledger.

- Individual loans may need guarantors or collateral.

- User can define that x percent of the loan amount should be available on one of the savings accounts or as shares. The percentages can be different for individual or group loans.

- The computer generated loan repayment schedule can be modified for every installment (date, principal and interest amount), even at the level of the group members. There is hardly a repayment schedule that cannot be handled by LOAN PERFORMER.

- At loan application or disbursement, data can be exported to Word for the creation of loan contracts.

- Loans can be disbursed in cash, by cheque, as a deposit to any of the the client's savings accounts or as a transfer to the - external - client's bank-account.

- Disbursements in installments is supported.

- Installment dates can be calculated as starting from the disbursement date or - in case of cheques - from the cheque clearing date. Installment dates can also be fixed on a certain date of the month.

- Repayments can be made in cash, by cheque, from one of the clients savings accounts or by bank transfer.

- Penalties can either be entered manually on a loan by loan basis, or calculated by LOAN PERFORMER for all loans in arrears. In the last case, there are several calculation methods to choose from.

- Automatic transfer can be made to repay loans in arrears from any savings account.

- Loans can be rescheduled by adding extra installments or modifying future dues.

- Loan applications, approvals, disbursements and repayments can all be imported from external files.

- LOAN PERFORMER can produce user-definable warning letters whereby the period and the contents of the letters can be defined by the user.

- Clients can be black-listed. Black-listed clients can't receive new loans.

- Loan Provision can be calculated according to 5 different user-definable classes. The GL accounts can be updated automatically.

- Loans can be written off on a loan by loan basis or automatically according to certain user-defined criteria.

- LOAN PERFORMER produces many portfolio reports, for instance Aged Arrears reports, Portfolio at risk, Performance Monitoring, Indicators reports and Collection Sheets. All reports can be filtered by period, branch, credit officer, loan product, loan fund, geographical area, business sector and different client or loan categories.

- A link can be created with planning data from an Excel spreadsheet and a report can be created that compares planning data with achievements.

- Loan data can be archived and de-archived. to top

|

|

|

|

|

|

| |

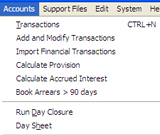

Accounting |

| |

- General Ledger, Assets, Debtors and Creditors modules.

- Maximum of 1,000,000 accounts.

- Maximum supported booking amount:

999,999,999,999.99.

- The chart of accounts can be modified to suit the user.

User can set the max width in number of digits of an account.

- General ledger transactions can be imported from external files.

- Export to third party accounting packages (Quickbooks, Sun Systems, Navision etc). to top

|

Click to view a larger image |

| |

- User can enter, modify or delete accounts. Accounts can be defined up to 5 sub-levels. Analysis codes can be

defined for products, funding agencies and branches.

- User can specify to which accounts automatic bookings have to be made (from shares, savings and loans ledger). This can be defined per product.

- Branch, Donor codes, Cost centres, Loan numbers, Savings Accounts serve as analysis codes.

- User can enter manual entries (in addition to the automatic entries for shares, deposits and loans, like payments for rent etc.).

- User can set a template for voucher numbers.

- User can define cost centres, link clients to cost centres and print all financial reports according to cost centre.

- Supports budgets (with option for multi-donor budgets).

- All automatic transactions are booked on cash basis, but user can calculate accrued interest and update the GL accounts on a periodic basis.

- Produces budget tracking, profits per periods, break down of accounts, trial balance, income and expense, cash-flow statements and balance sheet reports. to top

|

|

Tell us what you think would serve you better. Post us feedback about Loan Performer. |

|

|

|

|

|