10 Yrs LPF at Mukono & Kayunga Sacco On Saturday 7 December we visited Mukono & Kayunga Teachers Sacco. The institution celebrated 30 years of existence of their SACCO this year. They serve about 4,000 teachers. They already use Loan Performer since November 2003, about ten years now. We spoke to Robinah Ndikutuusa, the Internal Auditor.

Robinah: “In the beginning when we started using Loan Performer ten years ago, we were too green. We did not know about automation and the risks involved if you do not have your controls in place. We trusted everybody and that haunted us.” Mukono & Kayunga Teachers Sacco lost large sums of money because:

- Open Access to All Menus: They trusted their staff and left access to the Loan Performer menus open. Everybody could access everything. The result was that menu items like “Modify Transaction” under ‘Savings” and “Delete Loan Repayment” under “Loans” were misused by staff that changed deposits into withdrawals and deleted loan repayment and put the amounts in their own pockets.

- Importation to wrong accounts. The Sacco received salary cheques from the government and the person keying in this data put some salaries deliberately on the wrong account of a person she connived with. This person would then withdraw the money and share it with the data-entry person. This fraud was very difficult to discover and took almost a year to discover.

- Fraud with Passwords. There was abuse of passwords. One person peeped over the branch manager's shoulder to get her password, then logged in with the manager’s name and entered transactions in her name. There were also cases when the cashier went to the ladies, left the computer unattended and did not logout. Another person would then come, enter a transaction, take some money out of the till and quickly disappear. The transaction would then be registered in the name of the cashier and nothing seemed out of the ordinary.

- Rival Names and Ghost Clients. Some staff would mess up people's names in the Clients menu, add fake co-account holders or even enter non-members of the Sacco as clients. There were ghost clients who did not really exist but who got loans. Robinah: "All this was possible because in Uganda there is no proper identification of clients and because we left the doors open in Loan Performer".

Robinah: “We learned a lot from these issues. Access to the system has been limited to only those who need it, salary cheques I do myself, passwords have to change every 3 months, only 'strong' passwords are allowed and there is a strict cash control.This was all long time ago. I just tell you this so that you prepare yourself well before you start.”

Mukono & Kayunga Teachers Sacco has big plans for the year 2014: they want to upgrade to version 8, implement a Wide Area Network and link their members to ATM machines to reduce cash transactions in the SACCO. We support them!

Bank Reconciliation in LPF 8 Bank Reconciliation is a process that seeks to explain the differences between the bank balance as shown on the institution’s bank statement supplied by the bank and the corresponding balance of the General Ledger bank account of the institution at any one point in time. The reconciliation process should be done at least once a month. The implementation of integrated modules like Bank Reconciliation in Loan Performer (LPF) has helped end-users to improve their data quality and build stakeholder confidence.

How to reconcile bank accounts in LPF version 8?

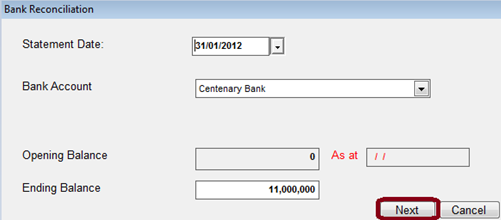

- Specify the date at which the reconciliation is to be done, preferably end of the month.

- Ensure that the correct bank account is selected at the drop-down menu during reconciliation. Note that the “Opening Balance” value will be automatically populated based on the previous Bank Reconciliation that was done.

- Enter the Bank Statement Balance as at the end of period as “Ending Balance”. This should be consistent with what the LPF General Ledger Bank Account has at that date.

- Click on the “Next” button after all fields on the first page are filled.

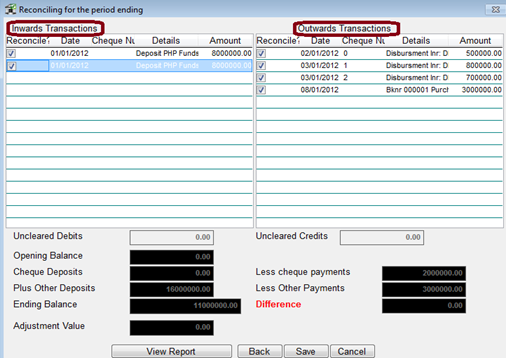

- LPF displays a list of all inward and outward transactions as of the specified period.

- In the event that all inward and outward transactions are shown on the Bank Statement and on the GL Account of the Bank as reflected by the zero difference below, the user can now click on the Save button to complete the process of reconciliation.

- If there are transactions that appear on the LPF Bank Account but don’t appear on the Bank’s Statement, they will be de-selected on the in- and outward transactions grid and LPF will equally show the adjusted values corresponding to those transactions.

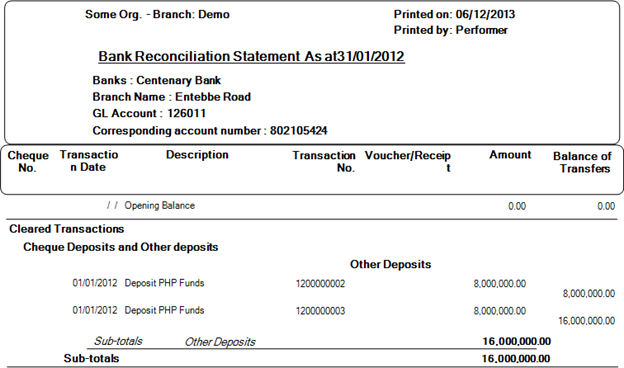

- LPF then automatically generates the Bank Reconciliation Statement as of the end of the period as shown in this portion of the report:

- The next month the deactivated transactions of the previous month will show up again for reconciliation.

|

We are reaching the end of 2013 and the beginning of something new. How fast it went! Looking back at all we did, we should highlight the most important things:

:

- Finished the implementation of Loan Performer for 43 Saccos for the Ministry of Finance and Planning in Uganda.

- Released Loan Performer versions 8.12, 8.13 and 8.14 with their respective sub-versions.

- Added several regulatory reports (Azerbadaijan, BCEAO, Ghana, Uganda, Zambia).

- Converted some of our francophone clients in West-Africa to version 8 and replaced their chart of accounts with the new BCEAO imposed chart of accounts.

- Did the same in Democratic Republic of Congo with the new DRC chart of accounts.

- Installed Loan Performer in several wide-area networks.

- Implemented Loan Performer for the first time in a replicated database environment.

- Added automatic updates and web-based help.

- Etc.

So what are the plans for 2014?

- Version 8.15 is still under development but is promising. We expect improvements on refinancing, day-closure per branch in a wide area network, the addition of client’s contact history, adding charges to a loan etc.

- We also expect progress on the conversion of our reports to Telerik and the business logic to C#.

- We expect our client to be able to access our CRM to retrieve progress on customer reported issues.

- We hope to reach 500 clients by the end of 2014.

Crystal Clear Software Ltd wants to thank its customers for its loyalty, its trust and patience. We wish all a Merry Christmas and a Happy New Year.

Are you afraid that the money that is disbursed in cash will be used for other purposes than what the loan was given for? Do you want to make sure that it is used for the business asset that it was applied for? Then disburse your loan in kind!

Loan Performer has a feature that allows you to disburse in kind. If a loan is disbursed in kind, the loanee normally receives equipment from a supplier. But before that you will have to register the details of the Supplier (Creditor) and then record the Supplier's invoice when it is received in Loan Performer. The payment to the supplier is registered when the loan disbursement in kind is entered.

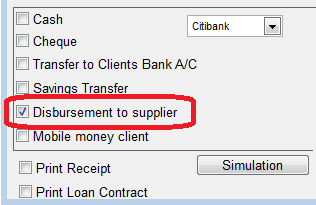

How to make a Disbursement in kind? The loan application, loan registration fees and loan approval processes remain the same as for a normal loan disbursement. To make a loan disbursement in kind, go to Loans->Loan disbursement. In the screen that shows up, tick the option Disbursement to supplier and select the supplier form the list of all registered creditors. The registered details for the supplier will be displayed in the respective text boxes.

Select the Invoice No. from the drop down list box and click the Save button to complete the disbursement.

Note that, at disbursement, the client only takes the equipment but the monetary value is paid into the Suppliers (Creditors) bank account.

You can view the Disbursement report at Loans->Portfolio Reports->Disbursement report.

You can view the Disbursement report at Loans->Portfolio Reports->Disbursement report.

Payment to the supplier is then done at Accounts->Purchases and Sales->Payments of Invoices Received. You can view the report on Supplier payments at Accounts->Purchases and Sales->Creditors reports->Creditors Payments.

Loan Performer will book these transactions as follows:

At entry of the Supplier’s invoice:

Stock account Debit

Suppliers (creditors) account Credit

with the total invoiced amount.

At disbursement (in kind):

Loan account Debit

Stock account Credit

with the disbursed amount.

at Payment of the supplier:

Suppliers account Debit

Bank account Credit

with the disbursed amount.

The total balance on the creditor’s as well as the stock account will be reduced by the monetary value of the equipment disbursed to clients. By the time all the equipment is disbursed to the client, the balance on both the creditors & the stock account will be zero.

From the Loan Performer Users Community

| We welcomed the following Loan Performer Users: |

| |

Argo, Kenya (regained)

Coopec Bonne Moison, DRC (regained)

EDAT, Tanzania

Lifua Financial Services, Tanzania

Universal Capital, Ghana

Soledd Financial Services, Zimbabwe

UTT, Tanzania

Zandamela Microcredito, Mozambique

|

| We had the following trainings: |

| |

We did an e-training in version 8 for Decision One Technologies in Zimbabwe. They are one of our representatives and as they brought us 3 or more clients in 2013, they are entitled to a free upgrade training to version 8. We also did a version 8 upgrade training for Bonne Moisson, DRC. |

| We had the following implementations: |

| |

Zambia: Care Coop Saving and Credit Society Ltd, training and implementation of version 8 for a new client (finished).

Zimbabwe: Masterlink Capital, training and implementation of version 8 for a new client (finished).

|

| Other News: |

| |

1. We have previously trained 14 of our staff members in SQL Server 2012. They all did course 10774A: "Querying Microsoft SQL Server 2012". This course has ended and we have now started course 10775A: "Administering SQL Server 2012 Databases". Twelve staff members are attending this course. The course is conducted by the same trainer from BCI Wrox. We hope to finish this course this month.

2. We have a new representative in Tanzania. This is Get up Tanzania Co. Ltd , alias

Mathias Msemo. He worked with Eclof before but now implemented Loan Performer for Kegoye Financial, EDAT, Goodhope Microfinance and Lifua Financial Services. He is based in Arusha and can be contacted: by tel: +255 784 653114; +255 752 115528 or email : mkmsemo@yahoo.co.uk.

|

Next Training Opportunities We have every first Monday of the month a training session of 12 days (2 weeks, Monday to Saturday from 9:00 to 17:00 hrs) in Loan Performer version 8. Next training starts Monday 6 January 2014. This takes place at our office in Kampala. Costs are 750$ per participant. At the end of the training the participants have to pass a test and a certificate will be issued. Use this link to download the training schedule.

If Kampala is too far, we can do an e-training via the internet. The full training takes 12 sessions of 4 hours at a cost of USD 150 per session. We can also tune these trainings to your needs and make them more efficient for you.

Need help with Loan Performer? Try the Online Help or Chat with our staff. |