New: Loan Charges in LPF 8.15 It’s a common practice among microfinance service providers to levy charges to their clients at any stage of the loan cycle. The reasons for these loan charges vary from provider to provider and so are the terminologies used to refer to these charges. This could for instance be a loan recovery charge or a legal charge for pursuing a delinquent borrower among others. In an effort to keep up with the ever-changing demands, Loan Performer (LPF) has been enhanced to accommodate for this new functionality. LPF provides the flexibility for the user to define the charge under menu 'Support Files' as well as to link the General Ledger Account Number (GL) for this charge at menu 'System/Configuration/Loan Product settings/Accounts GL 2/2'. Of course this can be set per loan product.

How to Configure LPF Loan Charges?:

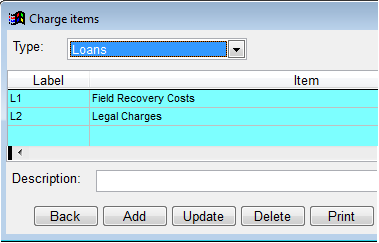

1. At menu "Support Files/ Charge Items", enter the name of the preferred loan charge:

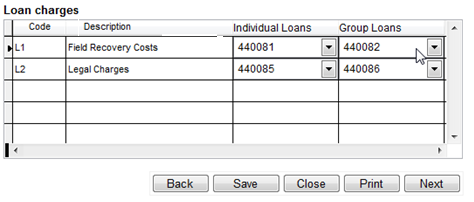

2. Define the GL Account for the Charge at menu 'System/Configuration/Loan Product Settings/Accounts G 2/2'. This is done per loan product.

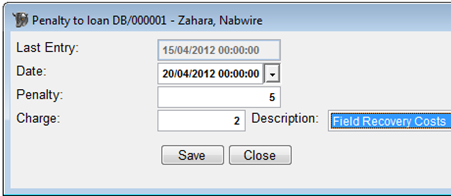

3. Finally, at menu 'Loans/Penalty/Charge for a single loan', you can proceed to levy the charge:

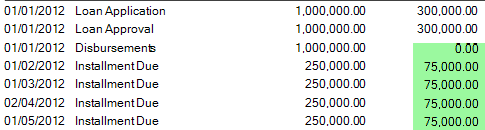

4. When you now enter a Loan Repayment, the total charge for this loan is USD 5. The priority for repayment is that the charge is given higher priority than the rest of the other dues. Where more than one charge is levied, the priority on charges is based on the entry date of the charge. Once posted, it’s booked on the respective GL Accounts and to the final accounts.

On the Loan Ledger Card, this charge is visible at the bottom of the report. The charge is also visible on the Outstanding Balances report. And a special report under 'Loans/Portfolio Reports' has been added for loan charges.

The “In Duplum Rule” is a Common Law principal that has been legislated in several countries around the world- some legislations being even more than 100years old. This rule states that interest on a debt will cease to run when total interest to be paid becomes equal to the unpaid principal. With the release of LPF 8.15 we can now configure this concept in Loan Performer.

1. Go to menu 'System > Configurations > Loan Product Settings'

2 Then check ‘Activate the Duplum Rule’ (the setting will be activated on all loan of this product).

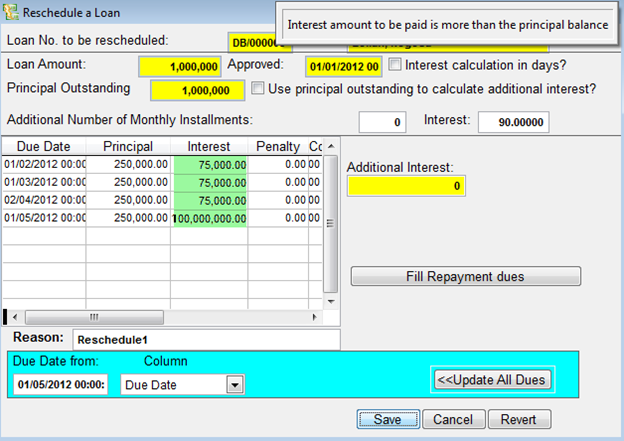

Once this option has been activated Loan Performer will not allow scheduling and accruing of interest on loans greater than the Principal Amounts. Below is an illustration showing the loan ledger card and the error message at the ‘Reschedule a loan’ window.

As in the figure below, the user tries to replace the interest with an amount of 100,000,000. The system would not allow this and displays a messge ‘Interest amount to be paid is more than the principal balance’.

|

How to Resolve Differences with the GL We often receive support questions regarding differences between the savings and loans balances and the General Ledger (GL) accounts. Let's have a look at what causes this and how we can resolve it.

First you have to make sure that each product and maybe even individuals and groups have their own GL accounts. In my (demo) database I have savings product S000 linked to 2 accounts: 210010 for Individuals and 210110 for groups. Differences can be caused by 1. changes in the configuration of the accounts overtime, 2. by users who post manually transactions to these 2 accounts and 3. other reasons (maybe corrupted records caused by power fluctuations, tampering with records, etc). These things should not happen, so we have to reconcile sub-ledgers and the general ledger on a regular, preferably daily basis. So how do we do this?

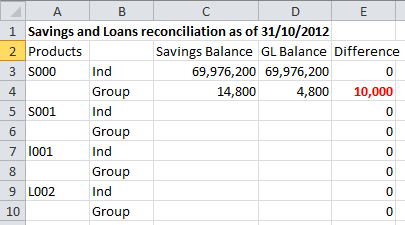

I maintain a spreadsheet like the following:

I look up the balances from the savings and loan reports and then from the Trial Balance and check whether they match. Now, in my example here, I see that there is a difference between the group savings balance for product S000 and the GL balance on account 210110. The savings balance is 10,000 higher.

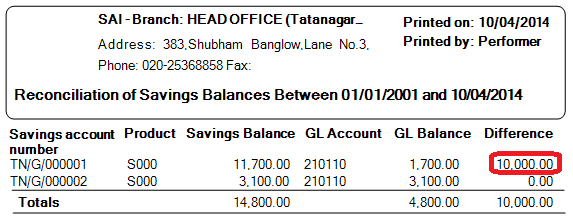

I now run the menu 'Reconcile Savings and Loan Transactions' for groups. This tells me that account number 1 is responsable for the difference. Further analysis tells me there is a transaction of 10,000 UGX on the savings account that does not appear in the GL. How can we solve this?

The recommended way to solve this is not to key in a manual transaction on the GL side to update the balances, but to delete the transaction from the savings ledger and to key it in again as a savings deposit. So we note the transaction number, go to menu "Savings/Modify Transaction" and delete the transaction. We have noted the day of the transaction before deleting and we now enter the deposit on the same day and for the same account. Next we go to menu 'Accounts/Reconcile Savings and Loan Transactions' and we run it for savings and groups and now the balances tally again. The same can be done for the loan accounts.

In Loan Performer you can set a payment to or withdrawal of a fixed amount from a client's savings account at a given frequency e.g. every 1st of the month. The money can then be transferred to another existing client or paid to a 3rd party.

The charges associated to this kind of transaction such as Invocation, Amendment, Execution and Penalty fees have to be set at System->Configuration->Savings->Savings Accounts Settings.

A standing order will normally be on the instructions given by the client and the LPF user will enter the details of this transaction at Savings->Standing Orders->Enter Standing Orders

. Loan Performer offers different execution frequencies of standing orders such as Monthly, Bi-monthly, Quarterly, Annually etc.

If your organization charges VAT on standing order transactions, Loan Performer will automatically calculate the amount if the VAT settings have been defined at System->Configuration->Savings->Savings Accounts Settings->VAT Settings

.

In order for the standing order transactions to be effected, you have to execute them at Savings->Standing Order->Execute Standing Order

. At this point you will be able to view and execute all the standing orders that fall in the specified period.

Loan Performer comes with a variety of standing orders reports to help you to monitor your performance and these include:

1. Active Standing Orders Report

2. Executed Standing Orders Report

3. Failed Standing Orders Report

4. Expected Transfers Report

From the Loan Performer Users Community

| We welcomed the following Loan Performer Users: |

| |

- Action for Children, Uganda

- Life for Children, Kenya

- Mudi Sacci, Malawi

- Oakfin Finance, Zimbabwe

- TLM Finance, Uganda

|

| We had the following trainings: |

| |

1. Last month we had a one week refresher training in version 8 for 1 person from Advance Uganda.

2. This month we have a 1 week training in Loan Performer 8 for one person from Palmart, Uganda.

|

| We had the following implementations: |

| |

Hadijah Nakiwala had a one week assignment for Visionfund Malawi and is now training Mudi Saccos, Polymed and Chitukuko Sacco also in Malawi. |

Next Training Opportunities We have every first Monday of the month a training session of 12 days (2 weeks, Monday to Saturday from 9:00 to 17:00 hrs) in Loan Performer version 8. Next training starts Monday 5 May 2014. This takes place at our office in Kampala. Costs are 750$ per participant. At the end of the training the participants have to pass a test and a certificate will be issued. Use this link to download the training schedule.

If Kampala is too far, we can do an e-training via the internet. The full training takes 12 sessions of 4 hours at a cost of USD 150 per session. We can also tune these trainings to your needs and make them more efficient for you.

Need help with Loan Performer? Try the Online Help or Chat with our staff. |