Loan Provisioning in Loan Performer Microfinance institutions engage in lending activities and regularly estimate potential losses that they might experience due to bad debts. Therefore, in line with accounting principles they set up provisions to cater for the credit losses as an estimated loss.

The creation of the provision is treated as an expense on the financial statement as a means of accounting for expected losses from delinquent and unrecoverable loans. How should we calculate the risk?

In Loan Performer loans in arrears are categorized under different classes. Each class is allotted a percentage based on the default probability for that class. This tends to increase with the number of days that the loan is in arrears.The longer the loan is in arrears, the less likely that the outstanding amount can be recovered.

For each of these classes you can set a percentage of the outstanding loan amount that Loan Performer has to add to the loan loss provision.

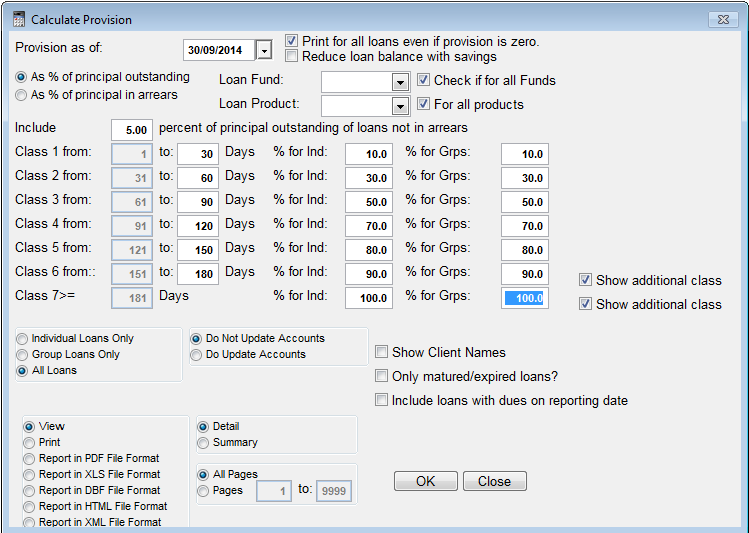

To calculate provision you go to Accounts->Calculate Provision and use the Calculate Provision window to set the parameters. The provision can then be calculated for specific or all loan funds and products.

You also have the flexibility of adding more classes by clicking on the "Show additional classes" button. You can do this for individual loans and for group loans separately.

Example: If, for Class 1, your organization calculates that loans from 1 to 30 days past due have a recovery rate of 90%, then you can make a provision for loan losses based on 10% of the balance of these loans. Similar estimates can be made for other classes as follows:

Class 2 from 31 — 60 days at 30 %

Class 3 from 61 — 90 days at 70 %

Class 4 from 91 — 120 days at 100 %

Before you can apply these percentages you have to consider the following options:

1. "Reduce loan balance with savings": With this option selected, the outstanding balance for each loan will first be reduced by the available savings balance before being considered for provisioning. The remaining balance will then be used in the loan provisioning process.

Example: If a delinquent loan has as outstanding balance of UGX 1,000,000 and the client still has savings of UGX 300,000 then the amount to be used during the provisioning will be only (1,000,000 - 300,000) = 700,000.

2. "As % of principal outstanding": this option lets you apply the percentage to the total outstanding principal for all delinquent loans.

Example: If a loan of UGX 1,000,000 has only one installment of UGX 100,000 in arrears then the whole outstanding of UGX 1,000,000 will be used during the provisioning.

3. "As % of principal in arrears": with this option selected, the provisioning amount will be based only on the principle that is in arrears.

Example: If a loan of UGX 1,000,000 has only one installment of UGX 100,000 in arrears, then only the UGX 100,000 that is in arrears will be used during the provisioning.

4. "Include ..... percent of principal outstanding of loans not in arrears": If for some reason you want to make a provision for non delinquent loans, then enter the percentage in the provided textbox, e.g., "5%".

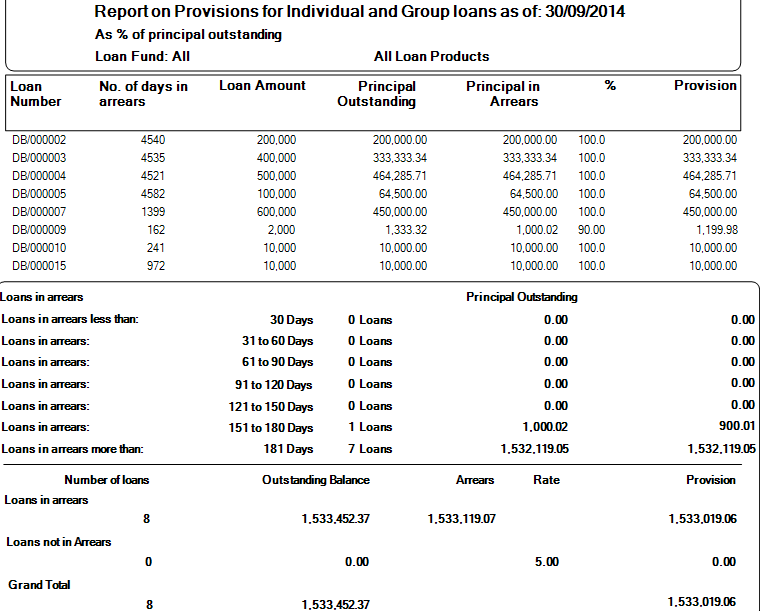

After setting the parameters that you want to use, you can then click 'okay' to preview the provision report and you indicate whether Loan Performer has to update the general ledger accounts with the result. The report will look as follows:

Note that if you set the Option "Do not Update Accounts", then Loan Performer only prompts you to save the provision calculation parameters. You then just click on the “Yes” button to save the parameters for future reference.

However if you set the option “Update Accounts” then Loan Performer will prompt you to print the displayed report before updating the account. This means that if you don't print the report, then the accounts will not be updated with the calculated provision.

At anytime you can view the provision account at Accounts->Financial Reports->Breakdown per Account.

Note:

The loan provision amount calculated will be booked on the loan loss reserve account defined at System\Configuration\Loan Product Settings\GL Accounts 1/2. When writing off loans at menu "Loans\Write off loans", the user won’t be able to proceed with the operation if the amount of loan provision is less than the total amount of loans to be written off. The user will receive a message that the “Loan Loss reserve is depleted” and will be required to increase the provision for bad loans first.

In this section our Technical Manager gives you some useful tips to make your life with Loan Performer more friendly.

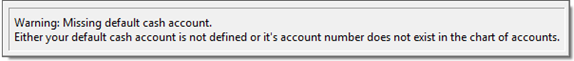

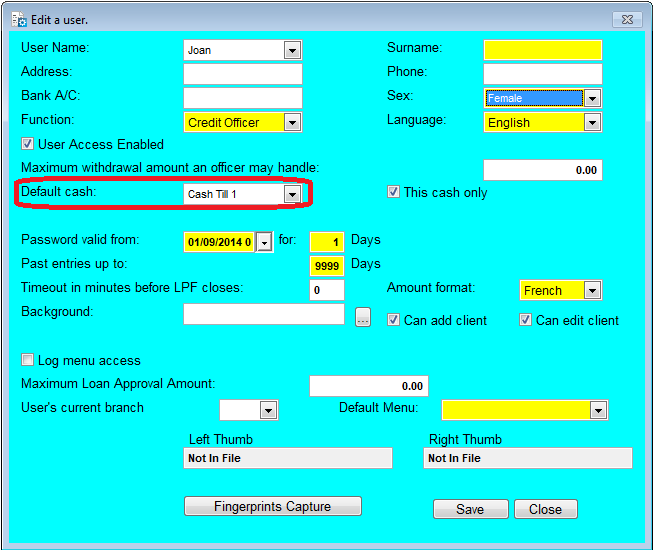

Missing Default User Cash Account.

Loan Performer expects the logged-in user to have a default cash account. If you try to login without a cash account specified in the user profile, Loan Performer will display the above notification. To stop this notification from displaying. Please go to menu Configuration > Manage Users > Click Edit> Select the Username >Select the Default Cash Account >Click ‘Save’.

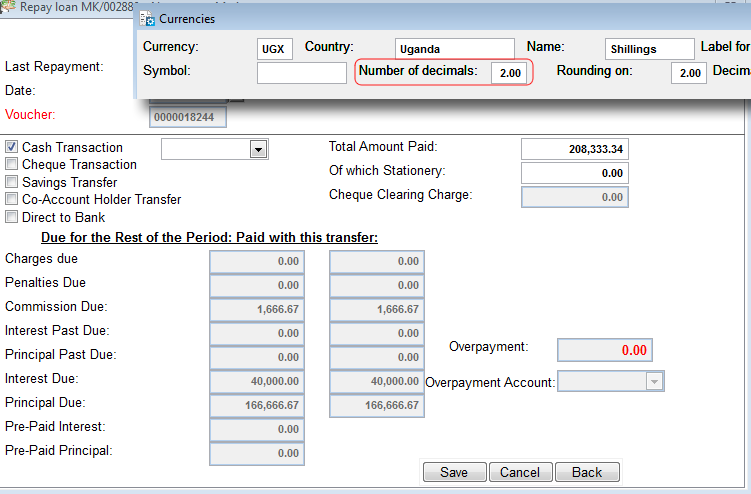

Transacting with Decimals.

In some countries you may not be able to do away with fractions in your day-to-day transactions. If you find yourself in a position where you cannot make non-fractioned Loan repayments, deposit and withdrawals transactions, then you may need to revisit your currency configurations. To set the operating precision of your currency please go to: Support files > Currencies> Select the currency> Enter the number of decimal places you would like to appear in your figures in the ‘Number of decimals’ box. Click ‘Save’. The figure below shows part of the currency configuration window and the Loan repayment window after configuration of the decimal places.

` `

Cannot drop the function ‘dbo.ServerArrPeriod’ because it does not exist or you do not have permission

The above error message usually occurs when the user does not have sufficient privileges to use the SQL Server database object or if the specified database object has explicit custom access restrictions. (To solve this problem please be sure you have basic knowledge of SQL database objects) Log into the SQL Server using SQL Management Studio > Go to the database node >Programmability>Functions>Scalar-valued Functions> Right click and delete ‘ServerArrperiod’> Restart the SQL Server Instance.

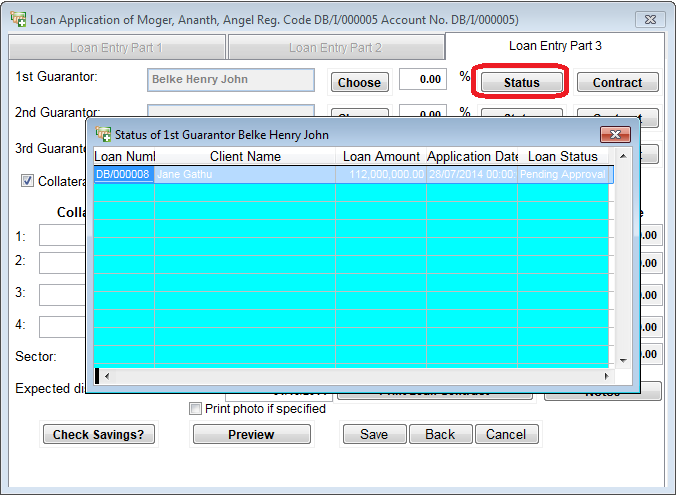

Does your Guarantor already Guarantee another loan?

When you are entering a loan application you wonder whether this guarantor is not already guaranteeing another loan. How can you quickly find out? At loan application, on the 3rd page, click the "Status" button. You will see:

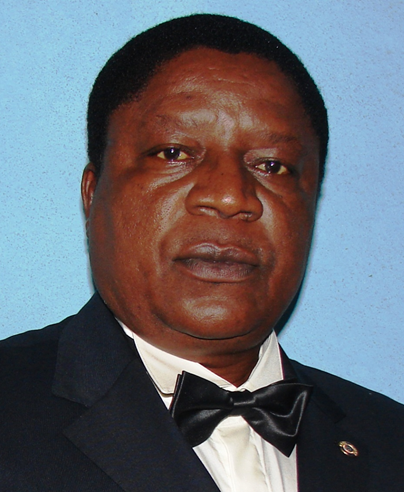

Peter Akote our Representative in Cameroon

In this column we present to you different country representatives who can help you with training, implementation or support issues. This time we introduce one of our representatives in Cameroon, Peter Akote. He is the Director of Baap Systems.

Peter Akote , our representative in Cameroon

Baap Systems is a computer consulting company setup in January 1995 and based in Limbe, South West Region of the Republic of Cameroon. Cameroon is a bilingual country (English and French).

My encounter with Loan Performer happened when a client of mine, a Micro Finance Institution, asked me to source for suitable software for their company. My search started with the many local microfinance software here in Cameroon. All of them were very expensive and not stable. I therefore cast my net out of Cameroon comparing all the existing microfinance softwares in the market. Having downloaded a good number of them and ran trials, there was one and only one product that stood out of the bunch - that was Loan Performer (7.10 at that time). Not only was this product easy to use with very simple and straightforward procedures, its user interface was quite appealing and simplified. What again finalised my decision to select this software was the offer from Crystal Clear Software to give me a detailed, online training. The rest is history as I have implemented Loan Performer in four different sites with success. We have Loan Performer in Equity Trust Finance, CBC Pension Fund, SONARA Workers Credit Union and Cameroon GATSBY Foundation. Catholic University Institute of Buea has a copy awaiting implementation.

As of today, all the locations we have implemented Loan Performer have never called us for any interventions as their training was thorough and the direct live help from Kampala is all they need to solve any problem they may encounter.

Loan Performer is being tested by three other companies now, and we are sure they will find it simple ad easy to use.

Peter Akote can be contacted as follows:

Address: P.O. Box 869 Limbe, Cameroon

Tel.: 237-33 33 27 84

Mobile: 237-77 73 36 96

Email : baapsystems@yahoo.com

Web: http://www.baapsystems.com

From the Loan Performer Users Community

| We welcomed the following Loan Performer Users: |

| |

- Danbro Holdings, Zimbabwe

- Female Global Billionaires, Uganda

- Girinka Mulenga, Uganda

- Harare Municipality Sacco, Zimbabwe

- Profit Kisoro, Uganda

- Yes Duchuruze Hamwe, Uganda

|

| We had the following trainings: |

| |

1.Loan Performer 8 for Power Microfinance, Uganda

|

| We had the following implementations: |

| |

1. The training and implementing of Loan Performer for Eclof Zambia has ended and took 3 weeks .

2. The training and implementing for Chibuku SACCOS in Botswana ended and took 4 weeks.

3 We had 1 day onsite assistance for Jesus Disciples Sacco in Kenya.

4. We did 1 day training and 1 day implementation for ForevAfrica in Uganda.

5. We are still doing 5 days WAN implementation for Innovative Microfinance in Ghana as well as 5 days nFortics mobile money integration. |

| Other: |

| |

1. One of our clients in Afghanistan ordered for the printing of ID cards from Loan Performer with the Zenius card printer. That will be available in 8.16. |

Next Training Opportunities We have every first Monday of the month a training session of 12 days (2 weeks, Monday to Saturday from 9:00 to 17:00 hrs) in Loan Performer version 8. Next training starts Monday 3 November 2014. This takes place at our office in Kampala. Costs are 750$ per participant. At the end of the training the participants have to pass a test and a certificate will be issued. Use this link to download the training schedule.

If Kampala is too far, we can do an e-training via the internet. The full training takes 12 sessions of 4 hours at a cost of USD 150 per session. We can also tune these trainings to your needs and make them more efficient for you.

We have started with an "EXPERT Training" in Loan Performer, targeting users of Loan Performer 8 who need to know all the ins and outs of this new version. It will be held on all 4 Saturdays during the month of September at our office. Upon request, the same can be done as an e-training. A training schedule is available here.

Need help with Loan Performer? Try the Online Help or Chat with our staff.

|